Your

PAIN FREE COMEBACK

Purchase May Be HSA/FSA Eligible

Thanks to our partnership with Truemed, you may be able to pay for the Pain Free Comeback Program using pre-tax HSA and FSA dollars - saving you an average of 30%.

We've seen our programs and coaching services help folks with all sorts of chronic conditions. Through our collaboration with Truemed, eligible customers can now use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds on Pain Free Comeback products!

This means you may be eligible to buy the PAIN FREE COMEBACK Program and 1:1 coaching sessions with pre-tax dollars, resulting in net savings of about 30%*.

To see your estimated savings, check out the TrueMed Savings Estimator.

How does it work?

1. Obtain your Letter of Medical Necessity (LMN)

Click here to fill out the application (less than 3 minutes.) The application costs $30, but you can use a coupon code when purchasing the Pain Free Comeback Program in the next step to recoup the $30.

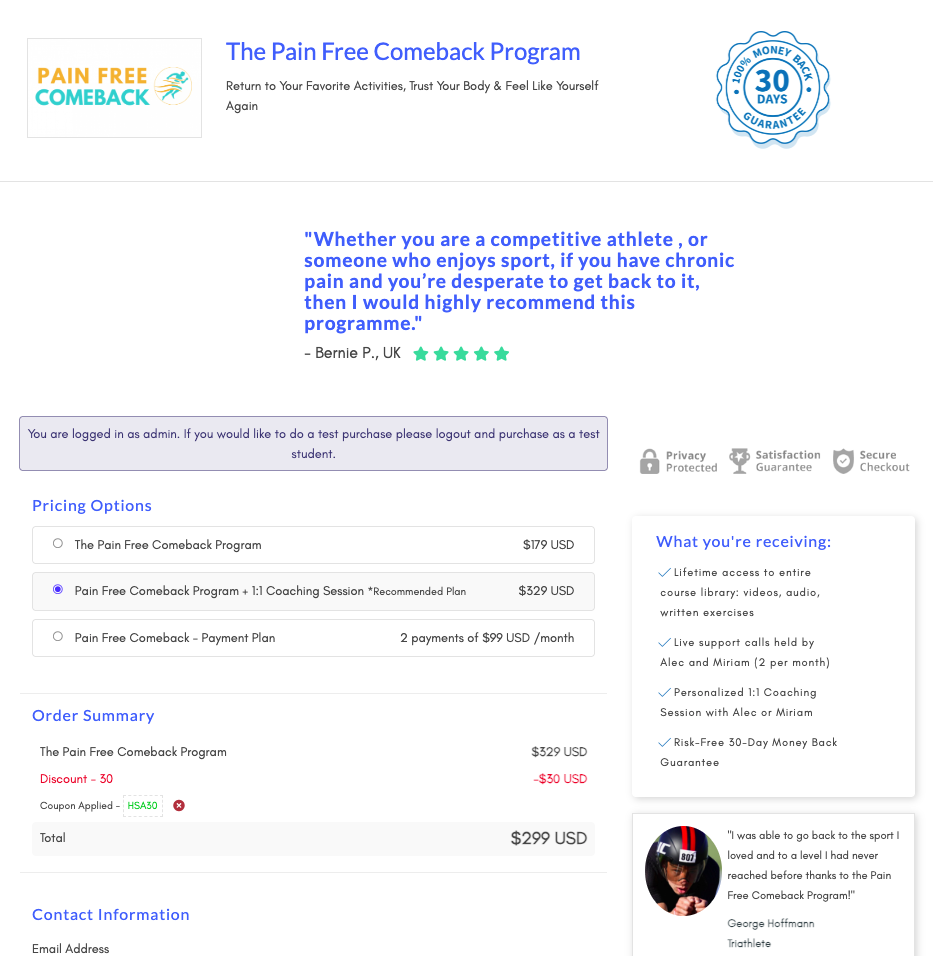

2. Purchase the PAIN FREE COMEBACK Program using a Special Discount Code

Use Coupon Code HSA30 to take $30 off the Program, effectively cancelling out the cost of the LMN (Step 1).

3. Get Reimbursed From Your Administrator

Submit your LMN along with your Pain Free Comeback Program invoice (On painfreecomeback.com, go to: My Account > Billing > Billing History) to your HSA/FSA program administrator.

Frequently Asked Questions (FAQ)

How does using my HSA/FSA account save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).

What are FSA and HSA accounts?

Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses. If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

Can I use my HSA/ FSA at Pain Free Comeback?

With a Letter of Medical Necessity (LMN) you should be able to be reimbursed for your Pain Free Comeback purchase. Note that we cannot guarantee that you will receive a reimbursement from your plan administrator, but if you obtain a Letter of Medical Necessity (LMN) and submit the Pain Free Comeback Program (an online live/recorded coaching service) then you can likely get reimbursed, just as others have. Note that we cannot guarantee reimbursement; it will ultimately be up to your program administrator to approve.

Can I use my HSA/FSA card at checkout?

For compliance purposes, you'll need to use your regular credit card, not your HSA/FSA card at checkout. From there, you can submit a reimbursement to your program administrator.

What is a Letter of Medical Necessity, and how does TrueMed help?

The items in your Truemed Letter of Medical Necessity (“LMN”) are now qualified medical expenses in the same way a visit to the doctor’s office or pharmaceutical product is. Food, supplements, and other wellness purchases qualify as medical expenses if they treat or prevent an illness, and a doctor substantiates the need.

Your Truemed LMN can satisfy the requirement to make your wellness spend fully reimbursable.

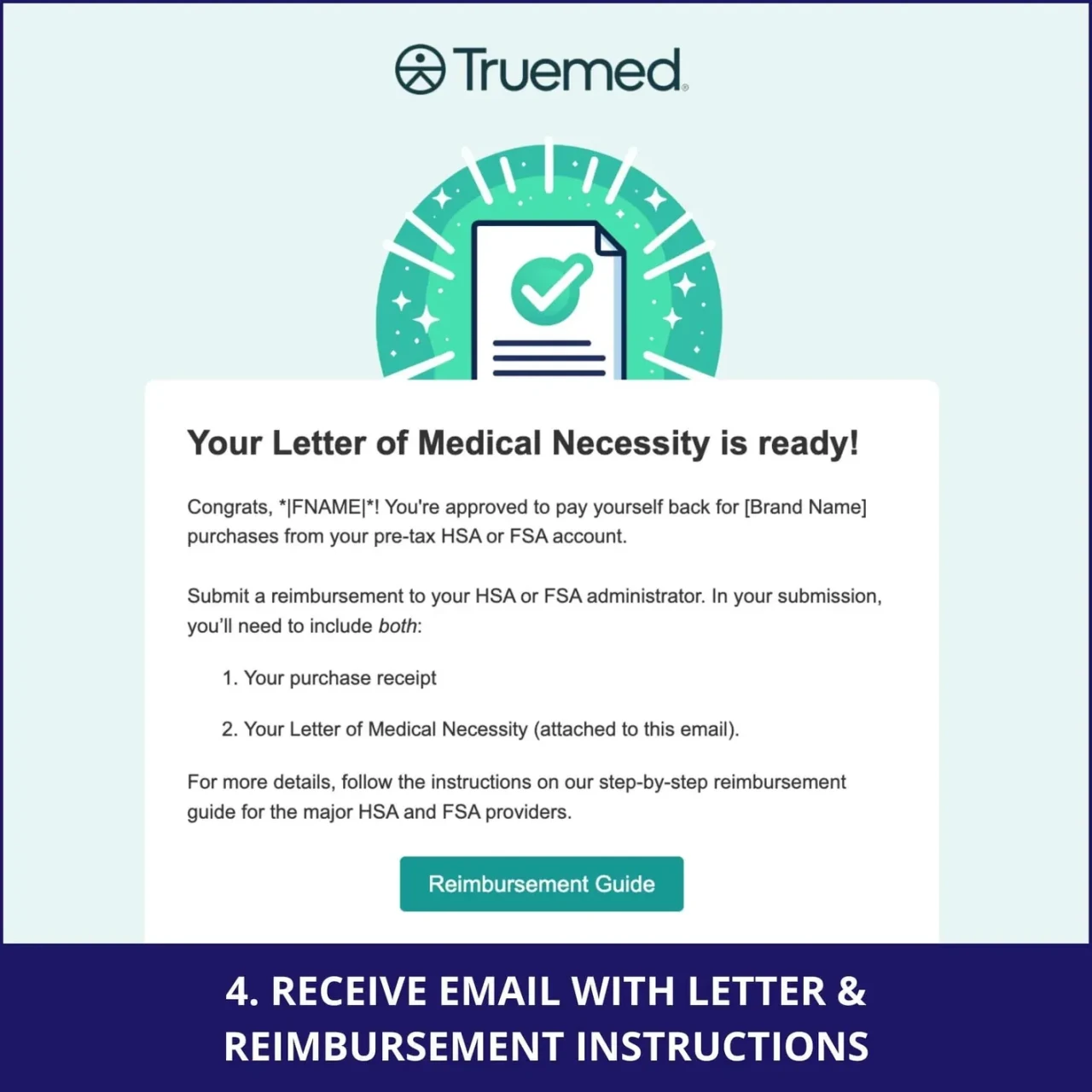

How long does it take for me to receive my Letter of Medical Necessity?

Generally it takes 2-5 hours. In some cases, Truemed’s provider team will require additional time to issue a letter of medical necessity based on the needs associated with an individual qualification survey.

If you aren’t seeing your letter in your inbox, check spam, then reach out to us at support@truemed.com for help.

How Long Is an LMN Valid?

The LMN you receive is valid for one year. For example, if your LMN is dated January 1st, it is considered valid through December 31st of the same year (inclusive), barring any specific restrictions from your HSA/FSA administrator. Any eligible product or service bought between the LMN’s start date and its expiration date can be reimbursed through your HSA/FSA—assuming your account has enough funds.

Do I need a new LMN for each Pain Free Comeback Purchase?

If you only needed the LMN to purchase a single item (e.g., the Pain Free Comeback Program or a 1:1 coaching session), then renewal is not required after your purchase. You can keep buying 1:1 coaching sessions under the same LMN until it expires.

Are there fees associated with using Truemed's services?

Yes, but you'll get the fee reimbursed when you purchase the Pain Free Comeback Program. The fee is $30 to obtain a Letter of Medical Necessity through TrueMed. When you purchase the Pain Free Comeback Program, simply use code HSA30 at checkout, and we'll take $30 off your purchase, effectively passing the cost onto us.

When should I use my FSA/HSA dollars?

You can use your HSA/FSA dollars all year long. However, FSA dollars expire at the end of the year and unused money may not rollover into the next year. Make sure to spend the rest of your FSA dollars before December 31st — use it, so you don’t lose it!

What happens if my reimbursement is rejected by my administrator?

We hope that won't be the case. If it does occur, we offer a 30-day money back guarantee should you wish to receive a refund on the program. Please note that your Letter of Medical Necessity (LMN) payment to TrueMed is not refundable.

How do I access my Pain Free Comeback Invoice?

You will receive an email after purchase with your invoice. You can also access your invoice by going to painfreecomeback.com: My Account > Billing > Billing History

I don’t have an HSA/FSA. Can I still benefit from Truemed?

Unfortunately, Truemed’s services are for individuals who have HSA or FSA accounts (or plan to fund one during open enrollment). We encourage you to ask your employer about information on your HSA or FSA.

I don’t live in the US. Can I still get reimbursed?

Unfortunately, HSA/FSA accounts are only for those based in the United States.

*Truemed is for qualified customers. HSA/FSA tax savings vary. Learn more at truemed.com/disclosures

Disclaimer: Pain Free Comeback provides education and coaching — we do not diagnose, treat, or provide medical care. HSA/FSA eligibility for coaching and digital programs is governed by IRS §213(d) and individual plan rules, which can be interpreted differently across administrators. While Pain Free Comeback is approved to use TrueMed’s Letter of Medical Necessity (LMN) process, TrueMed approval and/or an LMN does not guarantee HSA/FSA payment or reimbursement. Use of an LMN does not guarantee that any specific expense will be treated as a qualified medical expense, and eligibility determinations are made by each plan administrator. Some plans may deny or only partially reimburse. If you pay with an HSA/FSA card and your plan later determines the expense is ineligible, you are responsible for any resulting taxes, penalties, or repayments. Nothing on this page is medical, tax, or legal advice. Eligibility depends on your specific diagnosis, clinician guidance, and plan terms. Please consult your licensed healthcare provider, plan administrator, and/or tax advisor before using HSA/FSA funds. Keep your receipt and any LMN for your records.